MECKLENBURG COUNTY, N.C. — Just days after a WCNC Charlotte Defenders investigation exposed a government failure that sent hundreds of thousands of dollars in small business loans to delinquent taxpayers, elected leaders raised questions about the oversight at Tuesday night's Mecklenburg County Commission meeting.

Chairman George Dunlap requested a report detailing exactly which loan recipients owe delinquent taxes and how they much owe.

"I think that's a valid concern..." Chairman George Dunlap said of the WCNC Charlotte discovery. "...It would be appropriate to bring us a report on that."

Commissioner Vilma Leake also expressed concern.

"So, they're indebted to the county for taxes, but yet we have provided them with funds for their businesses," Commissioner Leake stated.

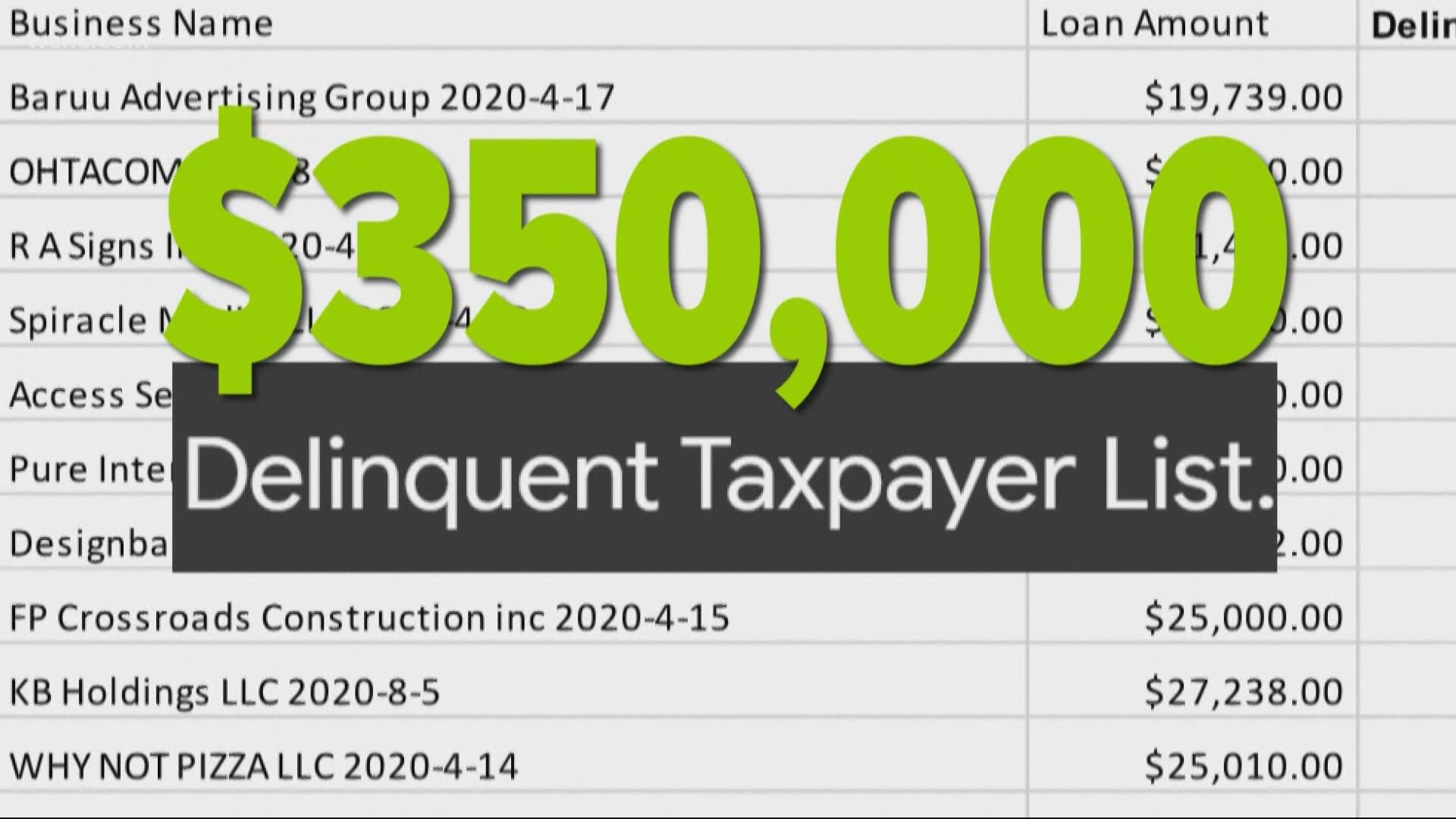

County records show despite owing a combined $21,000 in delinquent taxes, multiple small businesses received more than $350,000 in taxpayer-backed low-interest loans.

While some loan recipients owed a nominal amount of money, five owed at least $1,000 long before the pandemic impacted their businesses, according to tax records. The most delinquent owed more than $5,000, according to tax records.

Our investigation found the county, by way of the non-profit leaders hired to administer the $5 million loan program, previously failed to check for delinquent taxes before approving loans.

"It's important that we close those gaps," Commissioner Mark Jerrell said. "I don't care about who's right. I want to get it right."

In response to our investigation, the county promised to add a layer of oversight moving forward.

Of the five businesses that owed $1,000 or more, two of them have since settled up, according to tax records.