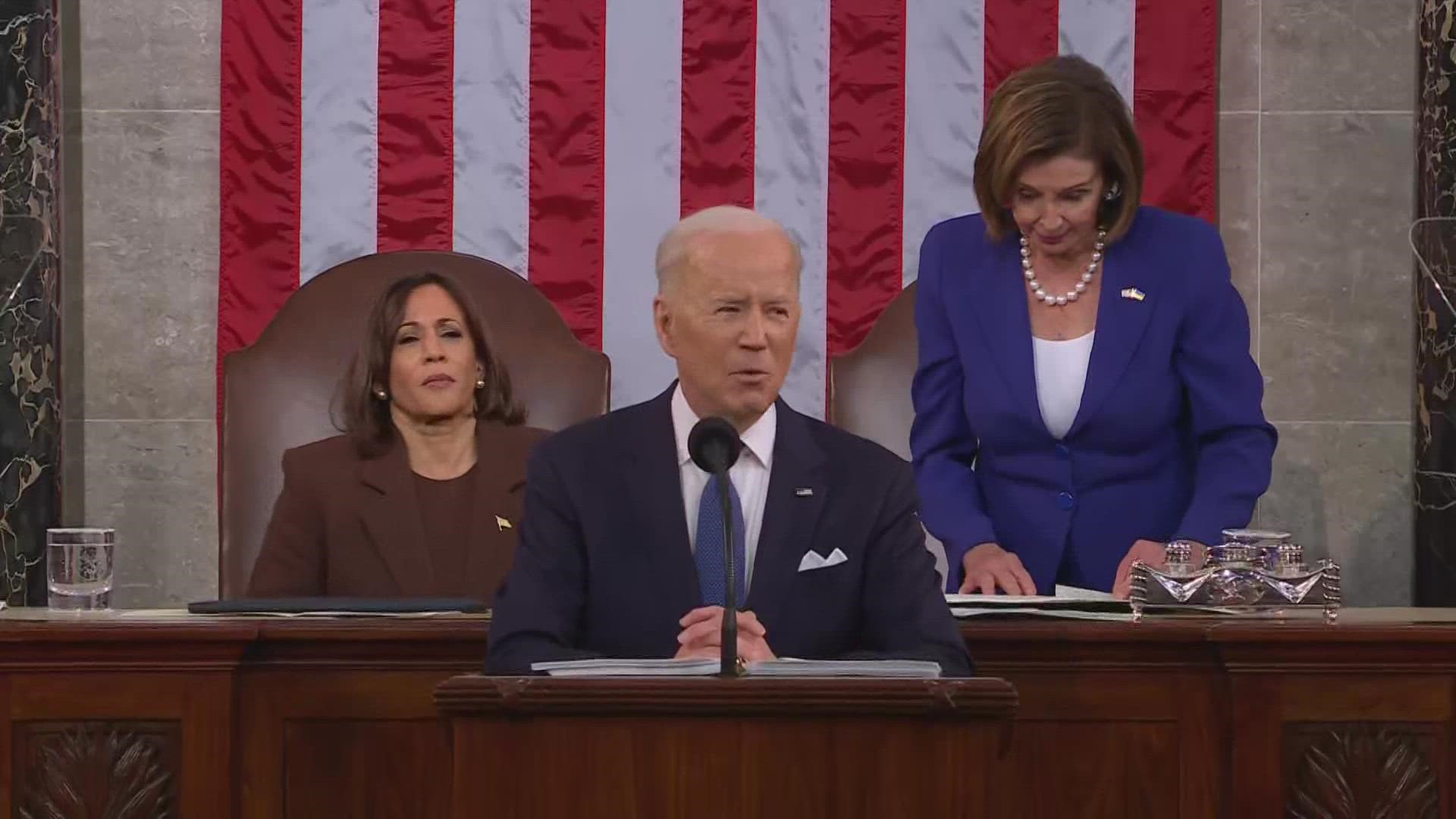

President Joe Biden urged Congress to pass an extension of the 2021 enhanced child tax credit during his State of the Union address Tuesday night along with other proposals aimed at reducing the cost of child care for American families.

"Raise the minimum wage to $15 an hour and extend the child tax credit, so no one has to raise a family in poverty," Biden told the joint session of Congress.

Biden also called on Congress to pass paid leave and to cut the cost of child care so that no working or middle-class family spends more than 7% of their income on that.

"My plan will cut the cost in half for most families and help parents, including millions of women, who left the workforce during the pandemic because they couldn’t afford child care, to be able to get back to work," Biden said.

He also called for universal pre-kindergarten for 3- and 4-year-olds.

What is the child tax credit?

While the child tax credit has been around for years, the amount was increased in 2021 as part of the American Rescue Plan COVID-19 stimulus bill last March. It went from one annual payment of $2,000 for most children to $3,000 or $3,600 depending on the age of the child. Parents also had the option to take that payment monthly as advance on the taxes they are now filing.

It also made the credit fully-refundable, which meant that even parents with very low or no incomes could benefit. The aim was to cut child poverty so that parents could have the money they needed during the year to pay for things like food, clothing and child care.

The nonpartisan Center on Budget and Policy Priorities (CBPP) said in December that 88% of low-income households receiving the monthly payments were using it on food, clothing, rent, mortgage and utilities. It was 91% if education costs are included.

An extension was part of Biden's Build Back Better social and environmental domestic plan. Although it passed the House, Senate Republicans and Sen. Joe Manchin, D-W.V., made it clear they would not vote for it. There has been no outward signs of progress toward passing it in three months.

The enhanced child tax credit expired in December. American families who relied on those monthly payments have not received them for two months, although they are due half of the money when they file their taxes this year.

The Center on Poverty and Social Policy at Columbia University said last month that the monthly child poverty rate rose from 12.1% in December to 17% in January -- the highest rate since the end of 2020. The center said it accounted for 3.7 more children going into poverty due to the end of the monthly child tax credit.

The tax credit reverts back to the $2,000 it was before for 2022, but it's not available as a monthly payment and will be part of tax returns filed next year.