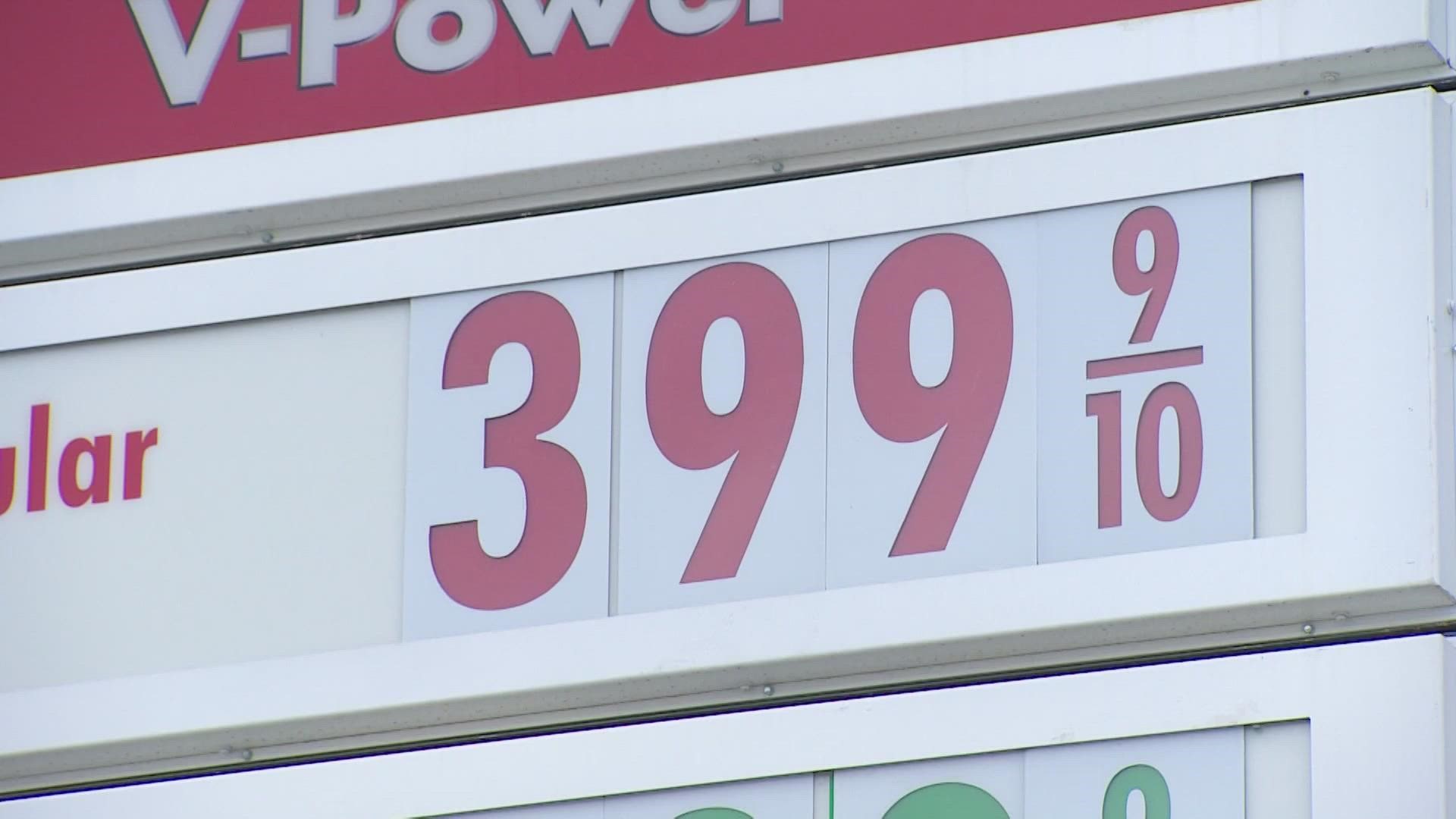

CHARLOTTE, N.C. — With gas prices surging to record highs across the country, drivers in the Carolinas are looking for ways to save at the pump.

One thought starting to make headlines in the U.S. is eliminating gasoline taxes at the federal and state levels. Some lawmakers argue this could make an immediate dent in those rising prices, but opponents say it may not be worth the few cents saved per gallon in the long run.

THE QUESTION

Is it possible to suspend state and federal gas taxes?

THE SOURCES

THE ANSWER

Yes, it is possible to suspend state and federal gas taxes.

WHAT WE FOUND

This week, Democratic governors in six states sent a letter to Congress urging federal lawmakers to pass the Gas Prices Relief Act to suspend the federal gas tax.

The Gas Prices Relief Act would suspend the 18.4 cents per gallon federal gas tax until Jan. 1, 2023, and reallocate money from the general fund to the Highway Trust Fund and the Leaking Underground Storage Tank Trust Fund to compensate for the suspension of the tax.

The Gas Prices Relief Act was introduced in both the Senate and House as bills S.3609 and H.R.6787, respectively. The bills were actually introduced in February prior to Russia's invasion of Ukraine in order to help alleviate the already dramatic rise in gas prices.

However, a lot of critics say because this is such a complex issue impacted by the price of crude and supply and demand, in the end, it will not be 18 cents worth of savings passed along to all of us.

What about at the state level?

For North Carolina and South Carolina to suspend their gas taxes, state lawmakers would have to work with their respective governors to make it happen.

However, suspending the tax would likely delay much-needed revenue for transportation projects in both states.

When asked if suspending the 36-cent state gas tax is something North Carolina Gov. Roy Cooper would consider, his press secretary issued the following statement to WCNC Charlotte, saying in part “with any tax cut, we would need to make sure the savings were actually passed on to consumers at the pump and not just added to the bottom line of the oil and gas companies. The administration will carefully review this issue.”

When gas prices were starting to rise in November, the South Carolina Department of Transportation got questions about a proposal to suspend the 26-cent gas tax there and backfill money for projects from other funds.

Back then, South Carolina DOT Secretary, Christy Hall released a statement saying in part “This proposal would derail the state's efforts to improve and upgrade our infrastructure by introducing a major cash flow crunch.“

While it is possible to suspend state and federal gas taxes, there are a lot of hoops to jump through to make it happen and doing so could come with delayed projects down the line.

VERIFY is dedicated to helping the public distinguish between true and false information. The VERIFY team, with help from questions submitted by the audience, tracks the spread of stories or claims that need clarification or correction. Have something you want VERIFIED? Text us at 704-329-3600 or visit /verify.