CHARLOTTE, N.C. — A lot of WCNC viewers are reaching out to us asking, “where’s the money?”

Some didn’t get some of the stimulus money they were owed. So how do people get what they are, or were, due? The IRS is suggesting that people claim that as a rebate credit when you file your taxes, but we are learning of issues with that.

WCNC is hearing from a lot of people who are telling us they did file for the missing stimulus as a rebate credit, however, they either don’t have the money yet, or they are being told to wait.

So, let’s walk through this.

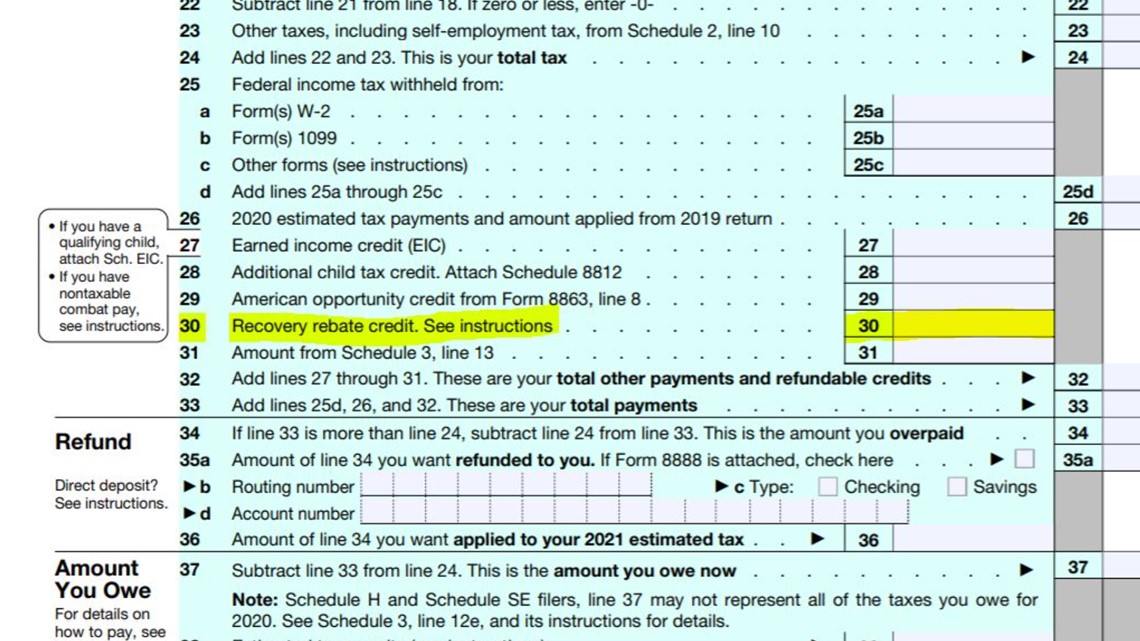

If you are missing the first or the second stimulus, at this point, claim it on your taxes as the recovery rebate. You’ll need the form 1040 or 1040SR and you enter what you are due on line 30.

That’s what Nidirra Williams said she did two weeks ago.

“They really couldn’t give me any information they just said I had to wait 10 weeks and my tax professional told me that was happening to a lot of people,” Williams said.

It’s a lot for the IRS as most of their employees are working remotely, and a third stimulus is coinciding with tax time where people are needing stimulus, one or two, *and their tax refund.

It’s confusing for a lot of people and a burden for the IRS. In the first week of accepting returns this year, the IRS said it received 35 million returns because of that delayed start of tax season.

“I know they are probably gonna just tell me I have to wait. I am frustrated. I just finished nursing school and ya know, I am at a crossroads and tax time really helps out,” Williams said.

WCNC Reporter Bill McGinty called the IRS and at this point is still waiting for an answer as to why people might be having delays beyond volume.

To make sure this runs as smoothly as possible, double-check your end of things to make sure everything is prepared and submitted properly and as soon as possible. If you missed some stimulus and don’t normally file a return, you’ll have to file one for 2020 to get that money, no matter your circumstances.