GREENSBORO, N.C. — The IRS confirms as of November 20, the agency has processed about 162 million returns of the 168.6 million returns it received this year.

That leaves about 6.6 million returns that are unprocessed and just waiting.

The agency got behind due to the nationwide stay at home order earlier this year triggered by the pandemic.

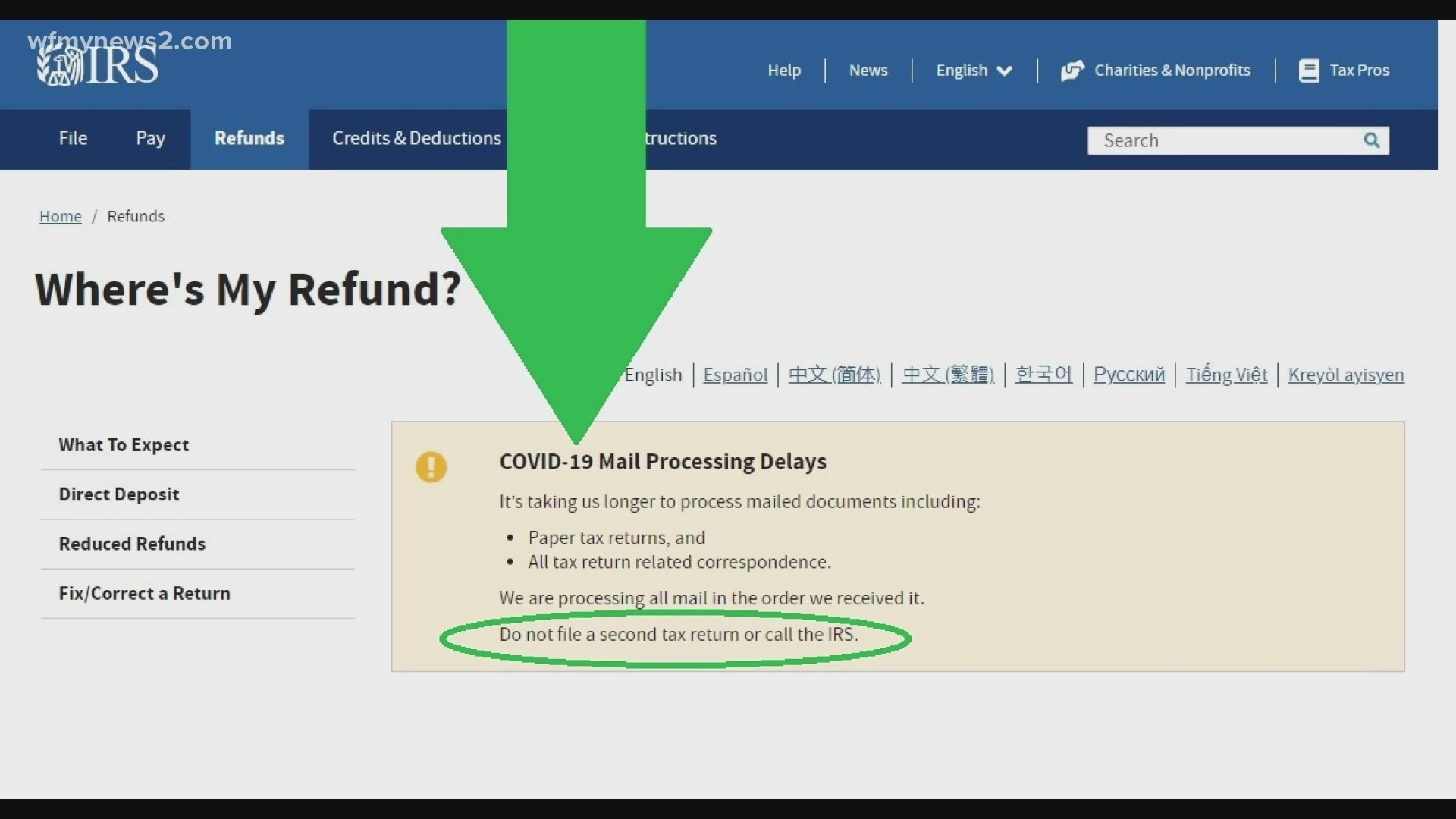

On the IRS website at the top of the Where Is My Refund page, there is a highlighted text box:

It's taking us longer to process mailed documents, paper returns, and any tax return related correspondence. Do not file a second tax return or call the IRS.

IRS leaders know people want to call, so at the bottom of the page, there is another highlighted box.

Expect delays if you have a paper return or had to respond to an IRS inquiry about your e-filed return.

You should only call if

--it has been 21 days or more since you e-filed

or the where's my refund portal tells you to contact the IRS

Again, there's a reminder to not file a second return.

Here's the good news, if you're getting a refund, you're also going to get interest money if you filed after April 15 and by the new Tax Day of July 15.

The interest rate is between 3% and 5% a year. The Motley Fool did the math. Let's say you were owed the average refund, $2,881. You could get an extra $34 in interest money. Which, by the way, you will have a claim as income. Yes, the IRS will take its portion of it next year.