CHARLOTTE, N.C. — If you got unemployment compensation in 2020 because of the pandemic, there are some tax implications you need to know about so that you are not surprised later this month as tax season is here.

Hundreds of thousands of North and South Carolinians lost their jobs and spent most of 2020 using unemployment benefits to get by. Many also received two stimulus payments from the federal government and added federal unemployment benefits. So, what’s taxable and what’s not?

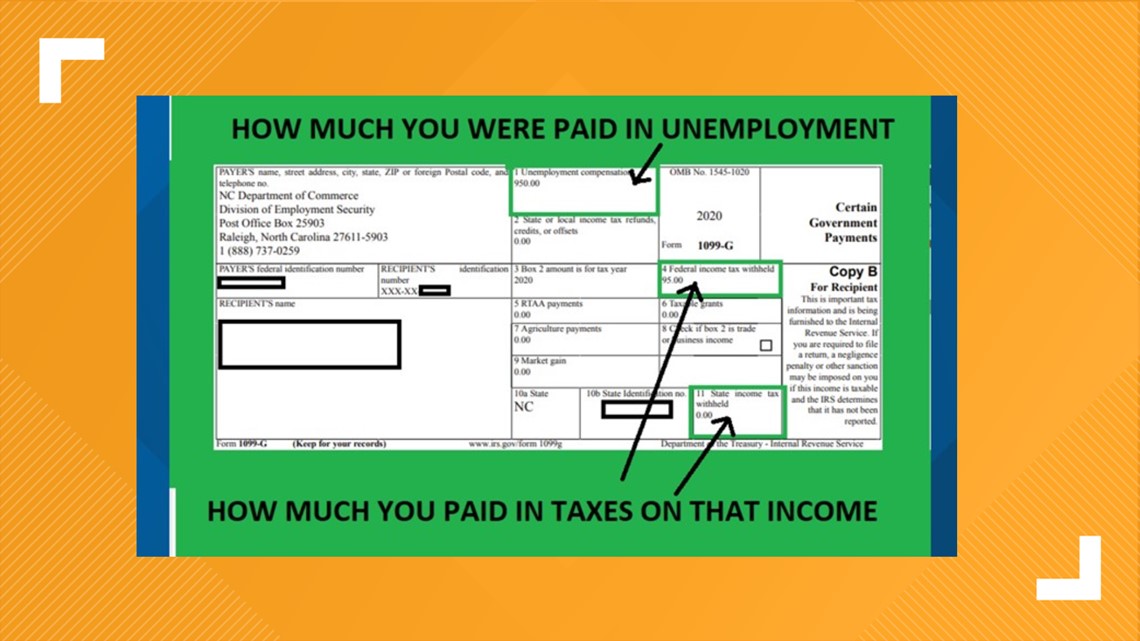

“I think most people don’t have experience with that, so when they go to file their taxes they will get a 1099-g, which means their unemployment benefit at the state level and the federal boost, will be taxable income, so the whole thing is taxable,” Justin Prusiensky, a certified public accountant in Charlotte, said.

If you were receiving unemployment benefits in North Carolina, you need to be watching for a seemingly vague notice in your email.

You must log in to your Division of Employment Security account, go to my documents, and download the form called 1099-g because unemployment benefits are considered taxable income, it’s not free money. The 1099-g form in any state will show the amount of unemployment compensation you received during 2020 in box 1, and any federal income tax already withheld in box 4.

Taxpayers then report this information, along with their w-2 income on their 2020 federal tax return. It’s not as complicated as it sounds, just know that the unemployment benefit is taxable income.

Federal stimulus money on the other hand is not considered taxable income, so you will not have to consider it as taxable income.

“Correct, and if you did not receive your stimulus and you were due that money, it will be offset, you can claim it as a credit, but it’s very individualized and you won’t know until you go to file taxes,” Prusiensky said.