CHARLOTTE, N.C. — More women are the breadwinners in their families than ever before, according to a Wells Fargo study that also showed millennials are a big reason why.

But the same survey shows many of those same women still say they never developed good financial skills.

It may sound crazy, but it wasn’t that long ago that women couldn’t do much financially without the help of the man in their life.

"When you think about 1971 -- before that women couldn’t even get a credit card in their own names," said Kathleen Malone, a Wells Fargo financial advisor.

The Wells Fargo study shows women are actually out-earning their partners in certain demographics.

According to the study, 54% of women now out-earn their partners. Diving deeper, the study says 32% of millennials and Gen X women now serve as the breadwinners in their homes, and 20% of boomers and traditionalists women serve as breadwinners.

"I was very surprised and pleasantly so – I think it’s a real celebration," Malone said. She said she's the breadwinner in her own home. "I was not the norm 20 years ago."

But she says now that it is more the norm, and more women should be dipping their toes in the world of investing.

"I think they’re hardwired to be good investors," Malone added. "Women are great at multi-tasking, great at organization, and love things on sale. They're the ones that go to the grocery store and see prices go up, they’re the ones that worry about day-to-day living expenses."

Malone has a few tips if you want to get started investing.

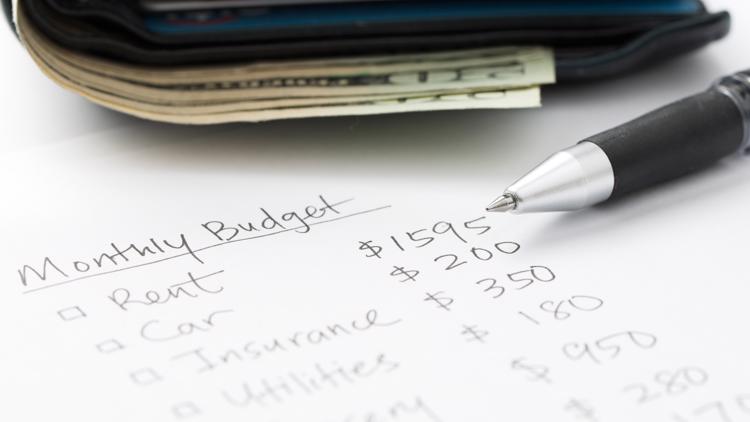

First, write down everything you have and everything you owe -- including credit card debt, mortgage, car payments, bank accounts, and student loans.

"I do this exercise with clients all the time and they always say gosh I didn’t know I had that much," Malone said.

Next, she says figure out what you spend. She says most people genuinely don't know.

WCNC Charlotte is always asking "where's the money?" If you need help, reach out to the Defenders team by emailing money@wcnc.com.

Malone said women are also changing the investment industry in general -- specifically using their money to make a point.

"A lot of my women clients are wanting to invest based on personal values," she said.

That includes everything from buying into companies based on social justice platforms or picking companies because they have women on the board.

"You can vote with your dollars and invest with your values," Malone said.

One other interesting note from the survey – three out of 4 millennial and Gen X women say they’ve made it a priority to educate their kids when it comes to finances.

Contact Michelle at mboudin@wcnc.com and follow her on Facebook, Twitter and Instagram.