People who owe back state taxes in North Carolina will now have their debt forgiven after 10 years, thanks to an unheralded law passed by the General Assembly in 2023.

A viewer alerted WCNC Charlotte about the significant development after a "Where's the Money?" investigation exposed a little-known state tax that has cost people found with drugs, including those never convicted, more than $100 million over the last 15 years.

Before the change, state law required the North Carolina Department of Revenue to forgive long-standing taxes only if the state had filed a lien. Under the amended law, the department is required to eliminate any remaining balance 10 years after the tax first became collectible.

"There was no statute of limitations for cases where a Certificate of Tax Liability (CTL/lien) had not been filed," Dia Harris . the NCDOR public affairs director, told WCNC Charlotte. "If a CTL had been filed, the statute of limitation was 10 years. This law essentially allowed the Department to abate unpaid tax after 10 years whether a lien was filed or not."

No More Debt, No More Uncle Sam

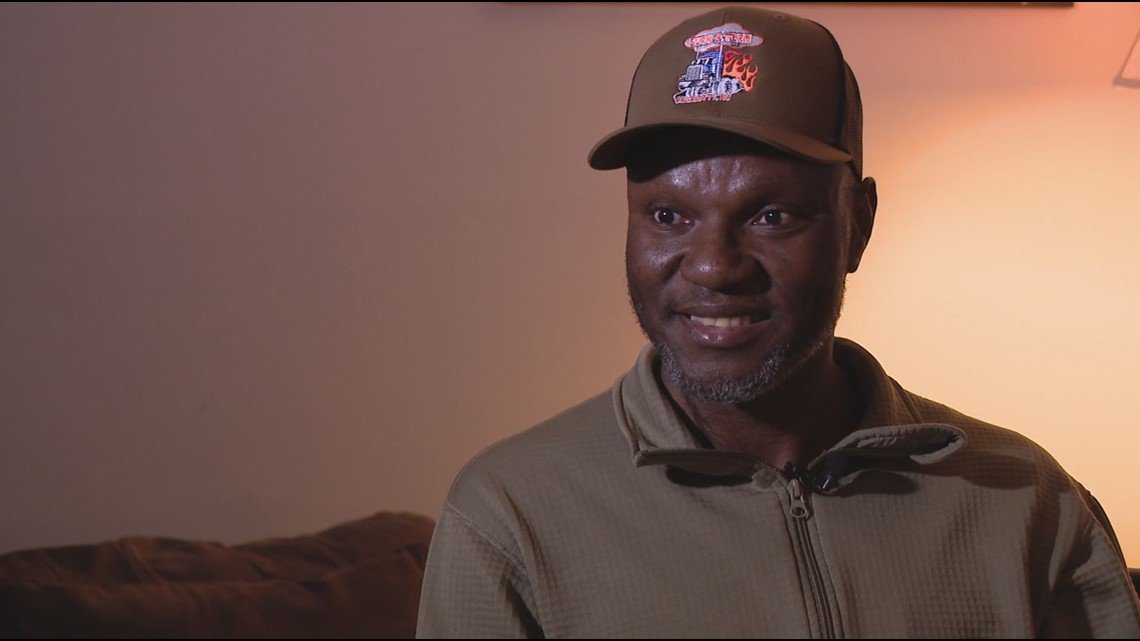

Antonio Mosley now knows the relief that comes with tax forgiveness.

As WCNC Charlotte previously reported, the small business owner had spent decades saddled with debt tied to a teenage mistake that not only sent him to prison, but burdened him with thousands of dollars in taxes tied to illegal drugs. After WCNC Charlotte amplified his plight, he learned the state had forgiven the more than $12,000 Unauthorized Substances Tax debt that remained. In his case, newly released state records show the lien law that was already in place led to his tax abatement in September 2022.

"It was a big relief. It's like a burden off my back. It was a burden," he said. "It makes me feel a lot better knowing I can move forward and not have to worry about the government anymore."

WCNC Charlotte is always asking "where's the money?" If you need help, reach out to WCNC Charlotte by emailing money@wcnc.com.

The debt had previously stood in the way of the small business owner's attempts to make the most of his second chance.

"I don't have to worry about Uncle Sam," Mosley said laughing. "No more debt. No more Uncle Sam."

A Step in the Right Direction

Others are likely unaware they too are now debt-free.

"The lack of knowledge can be just as harmful as the assessments themselves," North Carolina Justice Center Fair Chance Criminal Justice Project Director Laura Webb said. "They might not decide to go and buy that house or not to buy that car or put it in their name. They may decide not to take that employment because they don't want their wages garnished. It's very hard to overcome these assessments."

Webb has spent years fighting to end North Carolina's drug tax and get the state to forgive all debt. She is also working to get the word out about the small window people have to appeal the tax, so people know they can fight it.

"We saw where multiple people were being assessed for the same amount of drugs," she said. "I don't think it's fair."

Webb only recently learned about the change in state law that forgives tax debt after 10 years.

"It is a step in the right direction," she said. "We hope that the law will still go further."

According to NCDOR, the new statute of limitations law, just like the lien law before it, "applies to all tax types not just the (Unauthorized Substances Tax)."

WCNC Charlotte made multiple attempts over several weeks to arrange an interview with the bill's sponsor Sen. Bill Rabon (R), but his legislative assistant said the state senator was "not available." WCNC Charlotte also requested how much the state has abated since the new law took effect in 2023, but NCDOR has yet to provide that information.

For those whose tax debt is younger than 10-years-old, there is also an option to sign an Officer in Compromise. That allows the state to accept "full settlement of a liability" for less than what is actually due when "in the best interest of the State."

A Victory for Me

Antonio Mosley is grateful he is now free and clear.

"It's been a blessing," Mosley said. "It's a victory for me."

Despite his own victory, the Charlotte man is mostly worried about others.

"You've got people whose like me," he said concerned.

He wants to make sure they get the forgiveness they need as well.

Contact Nate Morabito at nmorabito@wcnc.com and follow him on Facebook, X and Instagram.

WCNC Charlotte's Where's The Money series is all about leveling the playing field in the Carolinas by helping others and breaking down barriers. WCNC Charlotte doesn't want our viewers to be taken advantage of, so we’re here to help. Watch previous stories where we ask the question “Where’s the Money” in the YouTube playlist below and subscribe to get updated when new videos are uploaded.