CHARLOTTE, N.C. — The cost of insurance for North Carolina homeowners could be going up.

Insurance companies are asking the state to let them raise rates by an average of 42% across the state.

According to a new Nerd Wallet analysis, homeowners' insurance in North Carolina is $500 higher than the national average. A requested rate hike could make prices even steeper.

The request is concerning for homeowners and renters who are already grappling with the rising cost of living.

"Groceries, and power bill, and most of the other things have certainly increased," renter Jared Hayslette shared.

If the requested rate hike is approved, homeowner David Sabine said his annual bill could go up $600, costing him nearly $2,000 a year.

Sabine said he was shocked to see the "exorbitant rate increase," so he started a petition on Change.org in January to speak out against it. The petition has nearly 350 signatures so far.

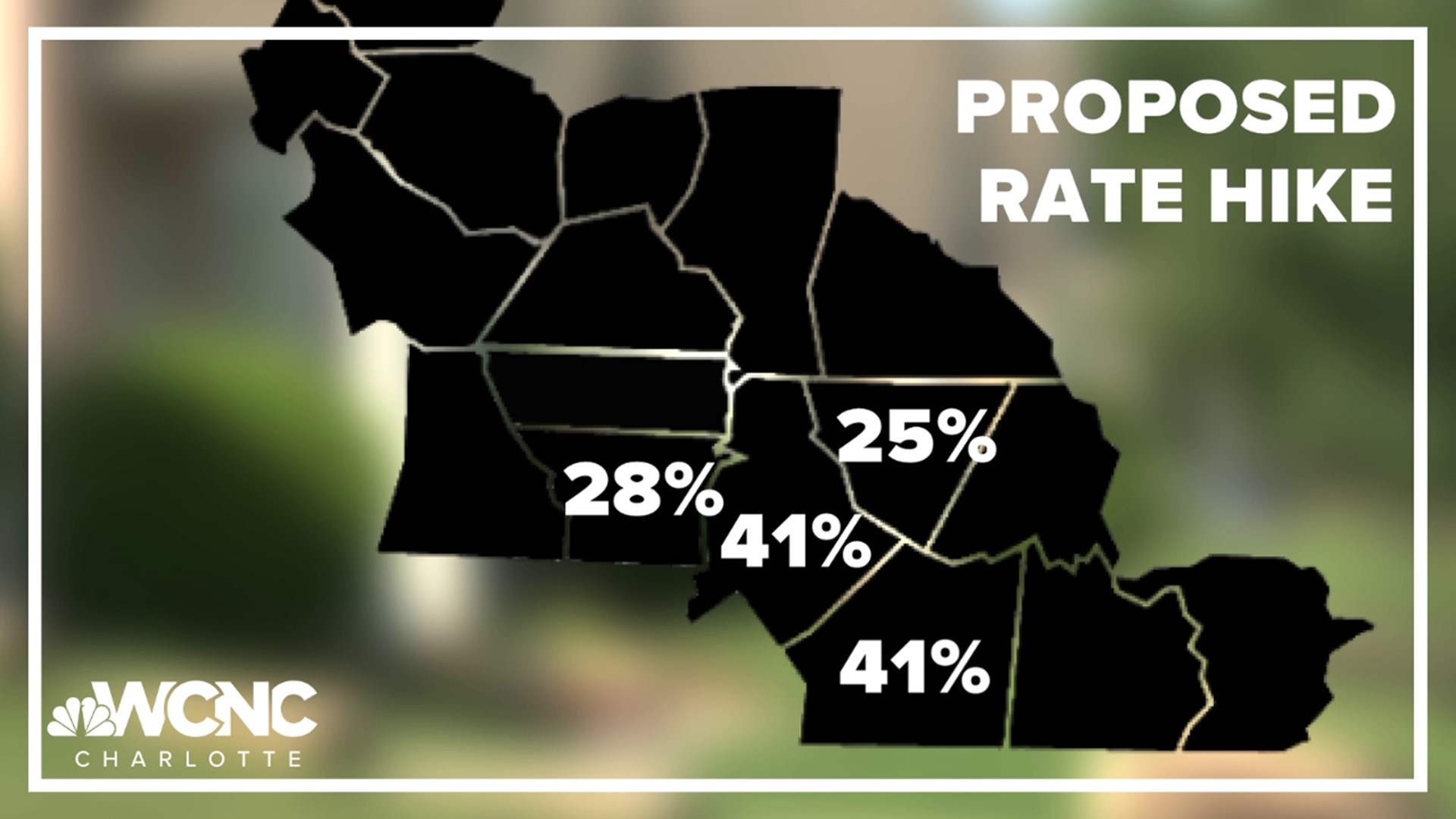

The proposed rate increases vary by county. Insurance companies want to double rates for some coastal counties. Local to the Charlotte area, they're asking to raise rates by 41% in Mecklenburg and Union Counties, 28% in Gaston County, and 25% in Cabarrus County.

"It just kind of seems ridiculous for them to come with these types of requests," Sabine said.

The last time the North Carolina Department of Insurance approved a rate increase for homeowners' insurance was in 2020. Costs went up an average of 8% after companies requested a 25% increase.

WCNC Charlotte asked NCDOI spokesperson Jason Tyson why insurance companies are requesting such a steep increase. Tyson said experts mostly point to inflation and worsening weather impacts.

"Obviously, we've had our fair share of pretty damaging storms," Tyson said. "In the last eight or nine years, we've had two that were very destructive. But, you know, that's a big part of this, according to many experts."

If climate change is driving up insurance, Hayslette hopes better solutions can be found than putting the cost completely on homeowners.

"[Storms] are only going to continue to increase in their frequency and their severity because that’s what we’ve seen in the last couple of years," Hayslette said.

NCDOI is hosting a public hearing on the proposed rate hike on Jan. 22 from 10 a.m. to 4:30 p.m. The agency says the hearing will be in the Jim Long Hearing Room in the Albemarle Building, 325 N. Salisbury St., Raleigh, N.C. 27603.

There is a virtual public comment option during the same time period. The link to this virtual forum is on NCDOI's website.

North Carolinians can also email their comment to 2024Homeowners@ncdoi.gov or send written comments to Kimberly W. Pearce. Her address is 1201 Mail Service Center, Raleigh, N.C. 27699-1201. Written comments must be submitted by Feb. 2.

After the public comment period, NCDOI leaders will either deny the rate hike request or negotiate with the North Carolina Rate Bureau, which represents the insurance companies.

Contact Julia Kauffman at jkauffman@wcnc.com and follow her on Facebook, X and Instagram.