GREENSBORO, N.C. — You know when you're trying to do something online and you keep hitting the submit or enter or refresh button hoping it will finally work?

Well, today could be the day!

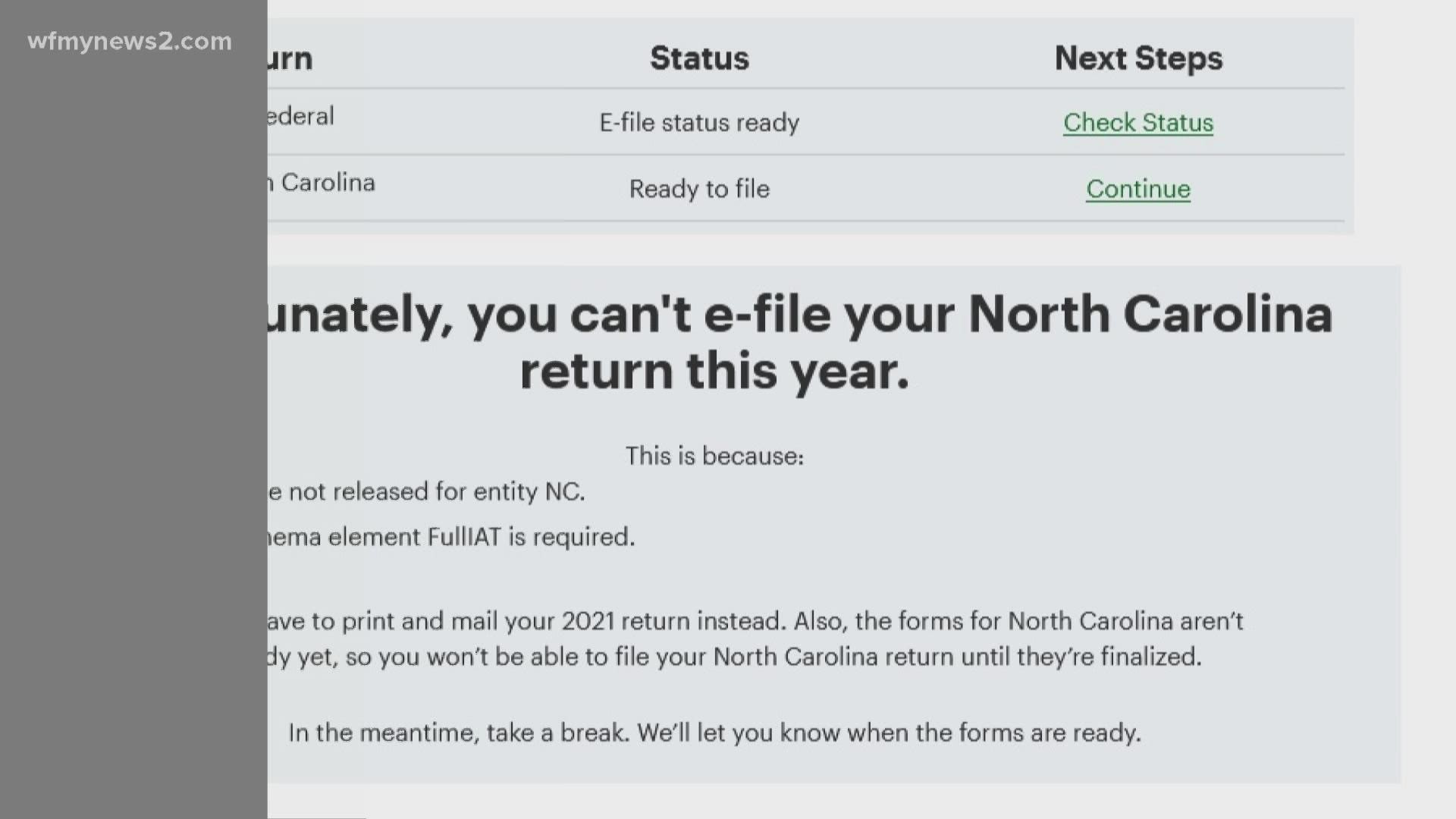

When tax filing opened in January, a lot of folks got a jumpstart—except on filing but they got a message from the North Carolina Department of Revenue the filing couldn’t be done at this time.

Thursday, a WFMY News 2 viewer messaged us saying;

Update. After trying every day to file those state taxes, I was finally able to file them today. No more errors stating NC issues. Just wanted to let you know. Thanks again.

Now, just because the software allowed you to file it doesn't mean there's still not a delay. This was just a delay on top of a delay.

North Carolina's DOR won't process returns until mid-February. So, while your return was accepted, it's not going to be looked at until mid-February.

What's the hold-up? the state budget was approved late and includes several tax changes. Here's the biggie, e-file it's your best chance of getting your refund quicker once the processing begins.

Ryan Dodson of Liberty Tax Services says it's important to know that all of your unemployment is taxable this year.

"Regardless of however much you received and if you received a dollar or whether you received $10,000, all of it is subject to income tax," Dodson said.

Dodson also said if you had a baby in 2021, you get the entire child tax credit amount for children under five years old, which is $3,600.

He recommends everyone file early and electronically.

"We're all in the same boat. We'll get there. I encourage everyone to file tax returns as soon as they have their information. Get in there, get it done, so you're going to know you're going to be first in line to get your refund, or you know that you have a while to save up some money and make that payment on April 18 this year," Dodson said.

The deadline to file your taxes or request an extension will be Monday, April 18.