GREENSBORO, NC -- James Simmons now knows he got scammed but he says his bank shouldn’t have to hold him responsible for the money lost because it only became available to him when the bank cleared the fake check.

“I got scammed and they took out every penny we had,” Simmons said.

It started when Simmons put his Scooter on Craigslist for sale and soon enough he got a buyer.

“And about two or three days later, UPS brought me a check,” he said about how the check was delivered.

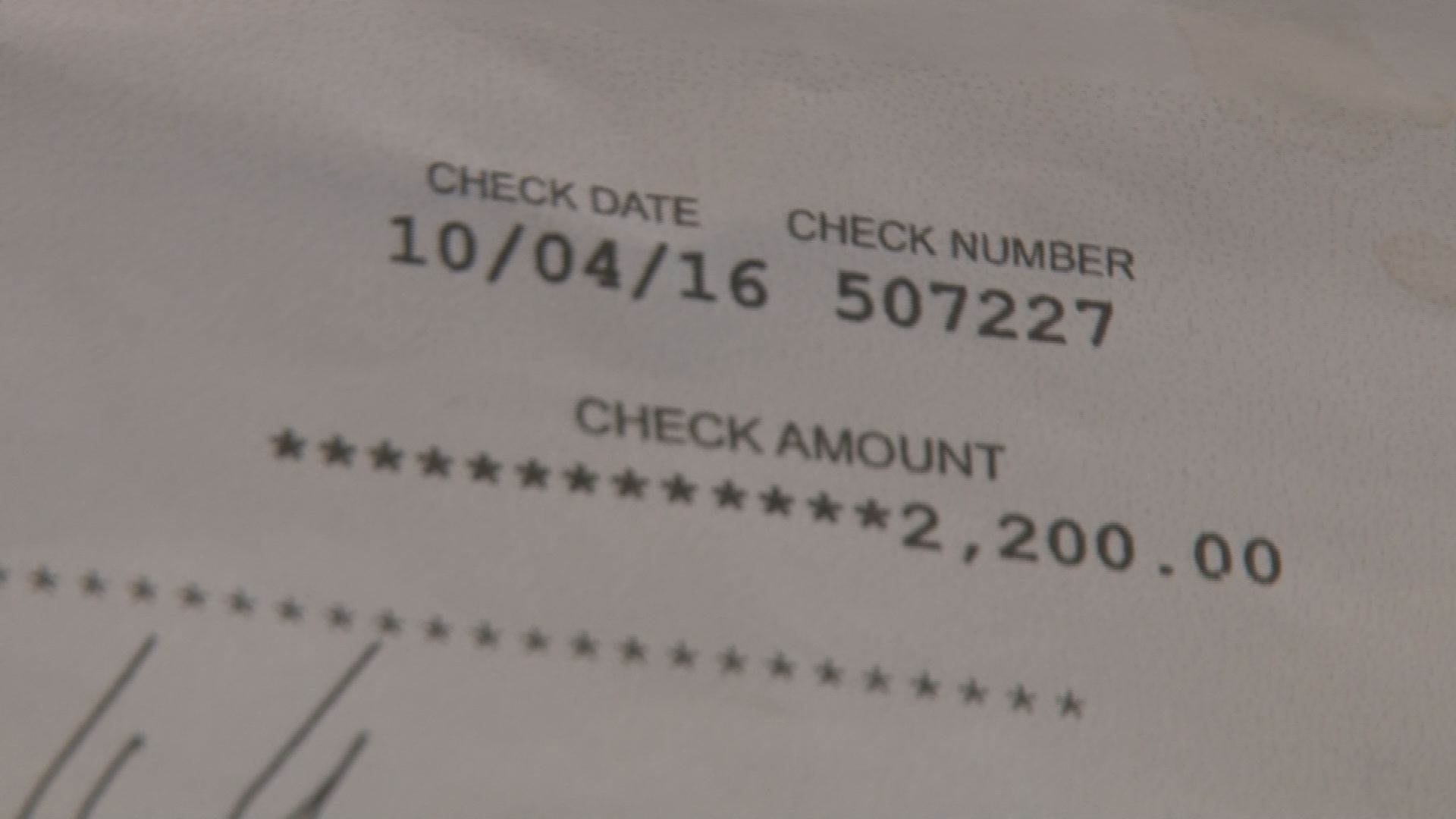

Simmons was selling the scooter for $675 but the check he received was for $2,200. The buyer, Simmons says, told him to deposit the entire amount into his bank account, keep the money for the scooter and send the rest to a moving company which would take the scooter to the buyer.

“I went and I did that,” Simmons said. “The check looked official. On the back of it. It had signatures and everything.”

According to updates posted by Wells Fargo to Simmons’ bank account, the check was deposited October 6, 2016

By the next day, it had cleared and the money was available in Simmons’ account.

Simmons took out the $1,475, as instructed by the buyer, and sent it to a moving company he now knows doesn't exist.

Six days later, the bank found out the original check was fake and Simmons is on the hook for the amount lost.

He says Wells Fargo should have known the check wasn’t real before crediting his account.

“The teller told my wife this money would clear the next day. We went, I checked on my checking account, and the money was in there. My money was in there,” Simmons said. “It's their fault because the cashier, the teller, should have called this [company on listed on the check] or called the bank to verify this check is good.”

According to Wells Fargo:

"Holds are intended to protect the customer as well as the bank, but they do not eliminate the possibility that a check will later be returned as fraudulent by the apparent 'paying bank.'

While we make an effort to confirm that deposited checks are valid prior to releasing any funds, it is important for customers to only accept checks from trusted parties, and to validate that a check has been verified before spending the funds or undertaking other business activities based on payment. When a customer is the victim of check fraud, we are happy to assist with any law enforcement investigations, and would be happy to assist in this case."

Glenn Kirk with Summit Credit Union weighs in, explaining that even though banks hold checks before clearing them for reasons like this, it's hard to blame the banks when a check a customer deposit turns out to be fake.

“It's a terrible thing when it happens,” Kirk said. “But the consumer has to ultimately take some responsibility to use some common sense about not getting money that they never had.”

Kirk continued, “Maybe the bank made a mistake by releasing the funds in a day, who know? Maybe it was a good customer of theirs, that's why they released it soon. But the check was not good to start with so the financial institution is going to try to recover that money any way that they can.”

If there's a silver-lining, it's that, Simmons didn’t lose his scooter. He ended up selling it to someone else, locally.

But again, the bank is holding him responsible for $1,475 he took out of his account before realizing the check was fake.