MATTHEWS, N.C. — As 2022 draws to a close, small business owners like Karessa Jackson face the daunting reality that it's time to start repaying their federal pandemic loans.

Jackson, the owner of a collision and auto repair shop in Matthews, expects to soon start making monthly payments connected to her $500,000 COVID-19 Economic Injury Disaster Loan (EIDL).

"It may be a struggle," she said. "It would be great if we had another six months."

The Small Business Administration had deferred payments for the last two-and-a-half years, most recently in March at lawmakers' request.

That grace period is now ending in the midst of an uncertain economy with a possible recession looming.

"We haven't really been able to really recover as of yet," Jackson said.

Jackson, who secured her EIDL with WCNC Charlotte's help "at a crucial time," used her loan to buy technology that allowed her business to expand.

She is one of almost four million small business owners who received a combined $390 billion in EIDL money. The low-interest loans, which provide up to $2 million for businesses impacted by the pandemic, generally carry a 30-year term, but there are fears borrowers may end up delinquent.

Certified public accountant Anne Zimmerman is with the advocacy organization Small Business for America's Future. She said EIDL recipients who are still struggling need to let the SBA know as soon as possible to see if the agency can help.

"Better to connect with them and tell them than to just ignore them," Zimmerman said. "If you contact the SBA and tell them, 'I can't pay it,' then they would be wise to at least work something out where you're at least paying the interest."

That communication is especially critical for larger loans the SBA required owners to personally guarantee.

An August 2022 National Restaurant Association survey found fewer than one in four owners who received an EIDL loan would be able to pay the principal and deferred interest. The association later sent a letter to the SBA asking for more flexibility.

Karessa Jackson said her business is just now turning the corner after a difficult 2022. She said her staff and revenue dwindled for much of the year.

"We had a real struggle this year," Jackson said. "We went from being able to make $150,000, $160,000, $170,000 a month to $90,000, the next month it was $50,000 and then it coasted for a few months at $35,000, which is less than my overhead."

She is now expected to pay nearly $3,000 a month toward her EIDL, but said she's committed to honoring her end of the agreement.

"It feels a little bit of pressure, but it just gives me more drive and ambition to get up and go every day," Jackson said.

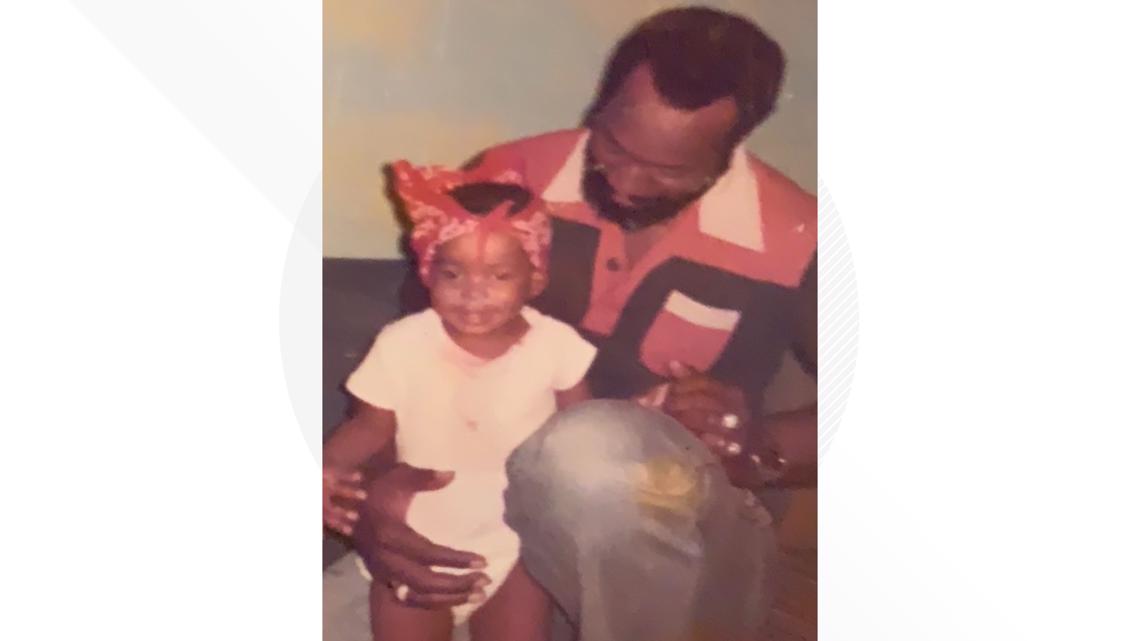

Jackson credits her parents, former business owners themselves, with sparking her drive. She said her father drilled home a mindset in her early years.

"Even at their lowest, they still got up and went to work every day," Jackson recalled. "My dad would say, 'As long as you get up and go to work every day, you'll work your way out of whatever hole you got yourself in.'"

Jackson doesn't just want to survive but needs to succeed. Failure is not an option, because it's personal. Her father died from cancer when she was just 18.

"My dad didn't get to finish his work. I have to finish," she said. "My whole life's goal is to finish being able to position my family in a way that my father wasn't able to finish."

How to contact the Small Business Association in North Carolina and South Carolina

An SBA spokesperson said small business owners with "specific questions about loan repayment" can email disastercustomerservice@sba.gov. Others should reach out to the SBA office in their area to discuss options like counseling or technical assistance.

"Borrowers may also contact COVID-19 EIDL Customer Service Center toll-free at 833-853-5638 to discuss the specifics of their loan and repayment schedule," SBA Public Affairs Specialist Nayana Sen said. "The most important thing is really that the SBA is here to help our small business owners for the long-term and business owners should take full advantage of the free or near free resources that are available to them."

In North Carolina, the SBA has an office in Charlotte located at 6302 Fairview Road, Suite 300. They can be called at (704) 344-6563. The agency's Raleigh office at 6600 Louisburg Road, Room 351 can be reached by calling (919) 532-5525.

In South Carolina, the agency has three offices. The location in Columbia is located at 1835 Assembly Street, Suite 1425, and can be called at (803) 765-5377. The office in North Charleston is at 3294 Ashley Phosphate Road, and their phone number is (843) 225-7430. The third office is in Duncan at 1875 East Main Street and can be reached at (803) 253-3123.

Contact Nate Morabito at nmorabito@wcnc.com and follow him on Facebook, Twitter and Instagram.

WCNC Charlotte is always asking "where's the money?" If you need help, reach out to WCNC Charlotte by emailing money@wcnc.com.